Fueling India’s Progress with Future-Ready Energy Infrastructure

What Do We Do

At Energy Infrastructure Trust (EIT), we enable long-term, future-ready infrastructure development in India’s energy sector.

As an Infrastructure Investment Trust (InvIT), we pool capital from investors to acquire, operate, and maintain high-quality energy infrastructure assets that deliver stable returns while supporting national growth.

SPECIAL PURPOSE VEHICLE

Our Special Purpose Vehicle exists to drive progress by enabling the reliable and sustainable transmission of natural gas. Our purpose is to serve every customer and community with integrity, safety, and care, fueling growth while safeguarding the environment.

As one of India’s leading natural gas pipeline operators, we are committed to efficient, transparent, and competitive operations, guided by the highest ethical and compliance standards. By ensuring the seamless flow of natural gas, we support industries, connect communities, and contribute to a cleaner, more energy-efficient future for all.

We create enduring value by:

Ensuring reliable and efficient energy transmission

Strengthening operational resilience and safety

Advancing India’s energy transition towards cleaner fuels

Supporting industrial expansion and regional development

Upholding the highest standards of governance, transparency, and sustainability

At EIT, we are committed to responsible asset ownership delivering energy securely, enabling economic growth, and contributing to a cleaner, more connected future for India.

We create enduring value by:

Ensuring reliable and efficient energy transmission

Best in class Operational Practices

Advancing India’s energy transition towards cleaner fuels

Supporting industrial expansion and regional development

Upholding the highest standards of governance, transparency, and sustainability

At EIT, we are committed to responsible asset ownership delivering energy securely, enabling economic growth, and contributing to a cleaner, more connected future for India.

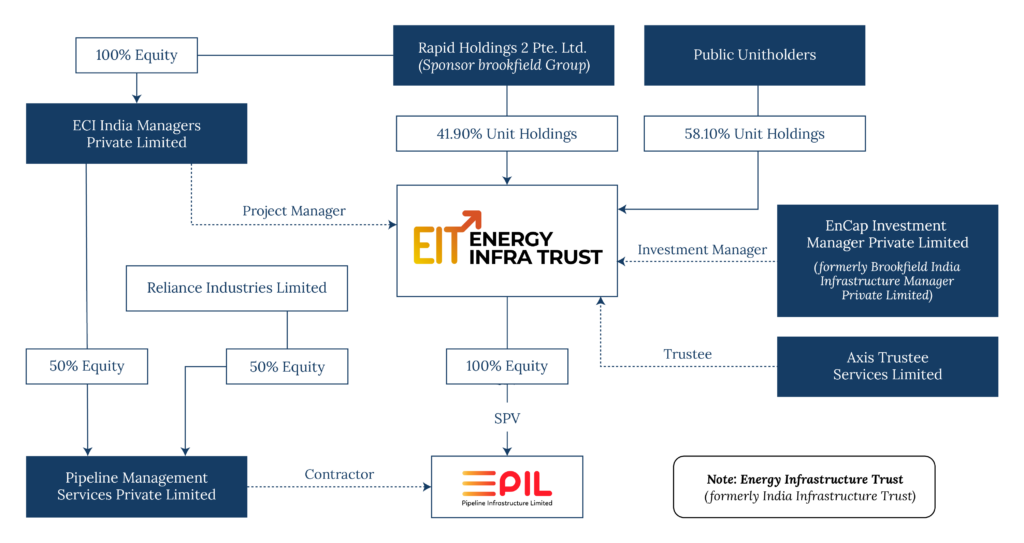

Structure

Board of Directors

Board of Director of EnCap Investment Manager Private Limited (formerly known as Brookfield India Infrastructure Manager Private Limited)

Mr. Prateek Shroff

Non-Executive Director and Chairperson of the Board

Mr. Prateek Shroff is a Senior Vice President in the Infrastructure Investments team at Brookfield, where he also oversees the Legal function for Brookfield Infrastructure in the region. His prior experience includes roles at Trilegal, Cyril Amarchand Mangaldas, and Tata Sons Pvt. Ltd. as Senior Legal Counsel, where he worked closely with strategy teams on structuring, negotiating, and drafting documents for major mergers and acquisition transactions. He holds a B.A. LL.B (Hons.) from the WB National University of Juridical Sciences.

Mr. Akhil Mehrotra

Managing Director

Mr. Akhil Mehrotra is an eminent business leader in the energy sector, bringing over 32 years of experience across oil & gas, power, and telecom industries. He is also the Managing Director of Pipeline Infrastructure Limited (PIL), a 1,400+ km cross-country natural gas transmission pipeline owned by Brookfield.

Akhil has led P&L responsibilities, M&A transactions, and multiple business transformations across Shell, BG (India), RIL and Gujarat Gas Ltd. He has previously served as Chairman of Mahanagar Gas Ltd., a Fortune 500 company, and has held board positions at Shell Energy India, Hazira Ports Pvt. Ltd, and others.

A thought leader in global gas markets and energy transition—including green hydrogen and policy development Akhil holds a B.E. in Mechanical Engineering, an MBA in Finance, and a PhD in Gas Markets. He has also completed executive programs at IIM Bangalore, Harvard Business School, Kellogg School of Management, and London Business School.

Mr. Arun Balakrishnan

Independent Director

Mr. Arun Balakrishnan is the former Chairman & Managing Director of Hindustan Petroleum Corporation Ltd. (HPCL) and the Founder Chairman of HPCL-Mittal Energy Ltd. (HMEL), a joint venture between HPCL and L.N. Mittal Investments.

He has also served as Chairman of the Scientific Advisory Committee, Ministry of Petroleum & Natural Gas, Government of India.

With deep expertise in Science & Technology, Project Management, Finance, HR and General Management, he currently serves as an Independent Director on the Boards of several respected companies.

A Chemical Engineering graduate, he completed his Post-Graduation in Management from IIM Bangalore and received the Distinguished Alumni Award in 2008.

Mr. Chaitanya Pande

Independent Director

Mr. Chaitanya Pande brings over 26 years of experience in credit, finance, and investments. He previously served as Principal and Managing Director at Lions Head Alternatives, leading acquisitions, credit, and structuring initiatives.

In his earlier role as EVP & Chief Investment Officer (Fixed Income and Structured Products) at ICICI Prudential AMC, he managed a USD 12+ billion portfolio.

He has received several industry recognitions, including Business Standard’s Debt Fund Manager of the Year (2012) and the Best Debt Fund House awards from Morningstar and CNBC TV18-CRISIL.

Mr. Pande holds a PGDBA from IMI Delhi and a Bachelor’s degree in Mathematics from St. Stephen’s College, Delhi. He currently advises Northern Arc Investment Managers and the Shriram group on fixed-income strategies, and also serves on the Board of Northern Arc Investment Managers.

Ms. Kavita Venugopal

Independent Director

Ms. Kavita Venugopal is a seasoned business leader with extensive experience across global and Indian financial institutions. Her career spans Corporate Banking, Risk Management, Corporate Finance, Relationship Management, Investment Banking, Strategy, and Governance.

She has held senior leadership roles at Abu Dhabi Commercial Bank (India) as CEO, Kotak Mahindra Bank, ANZ Grindlays, Standard Chartered Bank, and Yes Bank.

She currently serves on the Boards of multiple listed and unlisted companies and is a member/chairperson of several board-level committees.

Ms. Venugopal holds an MBA from the Faculty of Management Studies (FMS), University of Delhi, and a Bachelor’s degree in Economics (Honours) from Lady Shri Ram College, Delhi University.

Mr. Varun Saxena

Non-Executive Director

Mr. Varun Saxena is a Chartered Accountant with over 19 years of experience across Operations, Technology, and Risk in the Banking, Commodities, and Infrastructure sectors.

He is currently Vice President – Portfolio Management at Brookfield, where he manages investor relations, governance committees, global regulatory compliance, and supports acquisition due diligence.

His broad experience strengthens Brookfield’s strategic oversight and operational excellence across its infrastructure portfolio.

Leadership Team

Mr. Suchibrata Banerjee

Chief Financial Officer

Mr. Banerjee is a Chartered Accountant with over 22 years of diverse experience across the Oil & Gas and Power sectors. He began his career with Power Grid Corporation of India Ltd. (PGCIL) and has since held senior finance leadership roles at Oil and Natural Gas Corporation Ltd. (ONGC), Cairn India Limited, and Talwandi Sabo Power Limited (Vedanta Group).

His expertise spans corporate finance, budgeting, financial planning, compliance, and strategic financial management. In his most recent role as Vice President – Budgeting and Reporting at Pipeline Infrastructure Limited, he led several key initiatives, including the implementation of SAP HANA and the refinancing of Non-Convertible Debentures (NCDs). He brings strong experience in financial governance, project execution, and process optimisation.

Ms. Ankitha Jain

Company Secretary & Compliance Officer

Ms. Jain is a Company Secretary and holds a Master of Business Laws from the National Law School of India University. She has over 10 years of experience in corporate secretarial and regulatory compliance.

She has previously worked with MG Consulting Pvt. Ltd., TMF Services, Vistra ITCL India Limited, and Mindspace Business Parks REIT (Raheja Corp). Her expertise includes secretarial and FEMA compliance, equity/debt listed company governance, PIT compliance, statutory policy formulation, mergers & amalgamations, and fundraising activities.

Mr. Nilesh Salatry

Head of Audit, Risk and Compliance

Mr. Salatry is an Engineer (BE) and Cost & Management Accountant (CMA) with over 32 years of experience spanning Operations, Internal Audit, Risk Management, and Process Controls across Telecom, Power Systems, Industrial Systems, and Consumer Products.

He currently serves as Head – Audit, Risk and Compliance at Encap Investment Manager. Over the years, he has played a pivotal role in establishing SOPs, implementing robust processes, and designing and monitoring effective control systems across his previous assignments.

Sponsor

The Sponsor of the Trust is Rapid Holdings 2 Pte. Ltd., a Singapore-based private company and part of the Brookfield Corporation (BN) group.

Backed by Brookfield Corporation

Brookfield is a leading global alternative asset manager with over US$1 trillion in assets under management (as of March 31, 2025). With a 115+ year legacy, its portfolio spans infrastructure, renewable power, real estate, and more. Brookfield is publicly listed on the Toronto Stock Exchange (TSE: BN) and New York Stock Exchange (NYSE: BN).

World-Class Infrastructure Leadership

Brookfield Infrastructure, the group’s infrastructure-focused platform, manages one of the world’s largest and most diversified infrastructure portfolios, with ~US$214 billion in AUM. Its investments span utilities, transportation, energy, and renewables across North America, South America, Europe, Asia, and Australia.

Investment Manager

EnCap Investment Manager Private Limited (formerly known as Brookfield India Infrastructure Manager Private Limited) (“Investment Manager”) is the Investment Manager to the Trust, with effect from April 01, 2020. The Investment Manager was incorporated on May 06, 2010 as a private limited company under provisions of Companies Act, 1956. The Investment Manager is a wholly-owned subsidiary of BIF III Rapid IM Holdco. Pte. Ltd. and has over five years of experience in fund management. The Investment Manager’s registered office is situated at Seawoods Grand Central, Tower-1, 3rd Level, C Wing – 301 to 304, Sector 40, Seawoods Railway Station, Navi Mumbai – 400 706, Thane, Maharashtra, India

Project Manager

ECI India Managers Private Limited (‘ECI India’), a company incorporated in India having registered office in Mumbai, is the project manager of the Trust. ECI India is a wholly owned subsidiary of the Sponsor.

Trustee

Axis Trustee Services Limited (‘Axis Trustee’), a company incorporated in India, is the Trustee of Energy Infrastructure Trust. Axis Trustee is registered with SEBI under the Securities and Exchange Board of India (Debenture Trustees) Regulations, 1993 and has been allotted a registration number IND000000494.

Committees

Audit Committee

The Audit Committee is constituted in accordance with the SEBI InvIT Regulations and the SEBI Listing Regulations. Its composition, quorum requirements, powers, and scope fully align with the provisions of the SEBI Listing Regulations. All members of the Committee are financially literate and possess expertise in accounting or financial management, with the Chairperson holding professional qualifications in Finance and Accounting. The Committee is responsible for overseeing the Company’s and the Trust’s financial reporting processes and internal control systems. It operates under a formal Charter, aligned with Regulation 18 and Part C of Schedule II of the SEBI Listing Regulations. During the year under review, the Audit Committee met four (4) times.

Members

Ms. Kavita Venugopal

Chairperson

Mr. Arun Balakrishnan

Member

Mr. Chaitanya Pande

Member

Mr. Akhil Mehrotra

Member

Nomination and Remuneration Committee (NRC)

The Nomination and Remuneration Committee is established in accordance with the SEBI Listing Regulations. Its composition, quorum, powers, and functioning are in accordance with the regulatory framework.

The Committee’s responsibilities include:

- Setting criteria for determining qualifications, positive attributes, and independence of directors.

- Recommending appointments to the Board and Senior Management.

- Establishing processes for evaluating the performance of the Board, Chairperson, and individual directors.

- Formulating a remuneration policy for directors and Senior Management.

- Defining criteria for performance evaluation of independent directors and the Board.

- Creating a policy on Board diversity and attending to other duties prescribed under SEBI Listing Regulations.

The Committee functions under a Charter aligned with Regulation 19 and Part D of Schedule II of the SEBI Listing Regulations. During the year under review, the NRC met four (4) times.

Members

Mr. Chaitanya Pande

Chairperson

Mr. Arun Balakrishnan

Member

Ms. Kavita Venugopal

Member

Risk Management Committee (RMC)

The Risk Management Committee is constituted in compliance with the SEBI Listing Regulations. Its composition, quorum, and functional scope meet all regulatory requirements.

The Committee is entrusted with:

- Formulating and overseeing the implementation of the Risk Management Policy.

- Assessing the adequacy of risk management systems.

- Ensuring responsible operational conduct across the Company and the Trust.

- Implementing and monitoring the Environmental, Social, and Governance (ESG) framework.

- Overseeing matters related to health, safety, security, and the environment.

The Committee operates under a Charter aligned with Regulation 21 and Part D of Schedule II of the SEBI Listing Regulations. During the year under review, the RMC met four (4) times.

Members

Ms. Kavita Venugopal

Chairperson

Mr. Arun Balakrishnan

Member

Mr. Chaitanya Pande

Member

Mr. Akhil Mehrotra

Member

Mr. Varun Saxena

Member

Stakeholders’ Relationship Committee

In accordance with the SEBI Listing Regulations, the composition, quorum, powers, and scope of the Stakeholders’ Relationship Committee comply with the provisions of the Companies Act, 2013 and the SEBI Listing Regulations. The SRC is responsible for overseeing all matters relating to the interests of stakeholders of both the Company and the Trust. The Committee functions under a Charter aligned with Regulation 20, read with Part D of Schedule II of the SEBI Listing Regulations. During the year under review, the SRC met 1 (one) time.

Members

Mr. Arun Balakrishnan

Chairperson

Mr. Akhil Mehrotra

Member

Mr. Varun Saxena

Member

Ms. Kavita Venugopal

Member